Refresh Your Brand With Strategic Photography (And a Tax Perk Too)

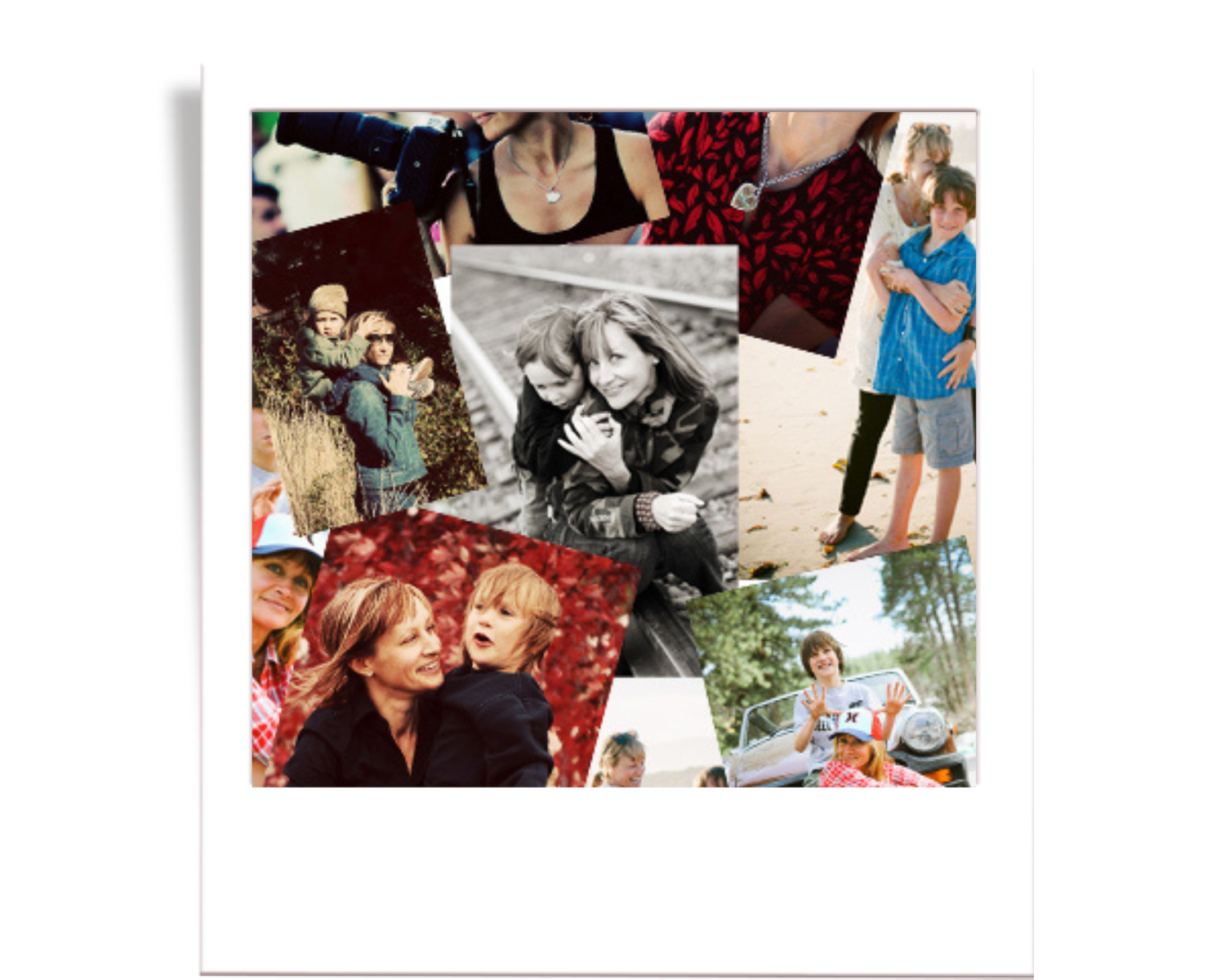

Let’s talk about something that is often overlooked but incredibly powerful. Your brand imagery. If you have been scrambling for content, recycling outdated headshots, or relying on iPhone snaps, it might be time for a refresh. Tax deductible brand photography elevates your visual presence and, in many cases, supports your bottom line too.

Your Brand Deserves to Look as Professional as You Are

Professional brand photography does more than make your website look polished. Whether you are a creative entrepreneur, an interior designer, a wellness professional, an architect, or part of a small but mighty team, strong imagery communicates trust. It sets the tone. It creates a visual language that tells your audience this is who we are, this is what we do, and yes, it is worth investing in.

Why Tax Deductible Brand Photography Is a Smart Refresh

Here is the part most business owners overlook. Your branding session might also be a tax deduction.

In many cases, professional brand photography used for your website, marketing, or social media can be considered a business expense. Of course, check with your accountant, but it is absolutely worth asking. Because if your new photos elevate your look and reduce your tax bill, that is a beautiful win.

Keep It Fresh With a Seasonal Strategy

Let’s take it a step further. Instead of scrambling for content each time a new season hits or a product launches, consider a subscription style branding package.

Think of it like seasonal check ins for your visuals. Fresh content every few months. New outfits, updated locations, evolving brand details. You stay aligned, your audience stays inspired, and you always have what you need when you need it.

No more digging for that one decent photo from last year’s launch. No more quick phone snaps that do not quite match. Just thoughtful, strategic imagery that reflects where your brand is headed.

Let your visuals work as hard as you do. Let’s talk and plan your own session of professional brand photography.

I am not an accountant or tax professional. Always consult your accountant to determine if brand photography qualifies as a deduction for your business.

FAQ: Tax Deductible Brand Photography for Small Businesses

Is professional brand photography tax deductible?

In many cases, yes. If your branding photos are used for your website, marketing, or social media, they may qualify as a business expense. Always confirm with your accountant or tax professional.

Who benefits most from brand photography?

Creative entrepreneurs, interior designers, architects, wellness professionals, realtors, and small teams all benefit from strategic brand imagery. Strong visuals communicate trust and elevate your online presence.

How often should I update my brand photos?

Ideally, seasonally or at least twice per year. Regular updates keep your visuals fresh and aligned with your evolving brand, offerings, and professional presence.

What’s included in a branding photography session?

Sessions often include headshots, behind-the-scenes imagery, product shots, team photos, location-based storytelling, and more — all curated to match your brand’s style and goals.

What is a branding subscription package?

A branding subscription offers scheduled photoshoots throughout the year. It ensures you have updated content every season without scrambling. Ideal for launches, updates, and consistent visibility. Contact for details on branding subscriptions collections.

Ready to plan your own brand photography session? Contact me here to schedule or learn more about branding subscription collections with your Truckee brand photographer. Also to take care of calendar 2025 we can plan now, put dates on the books in following year.

+ view the comments